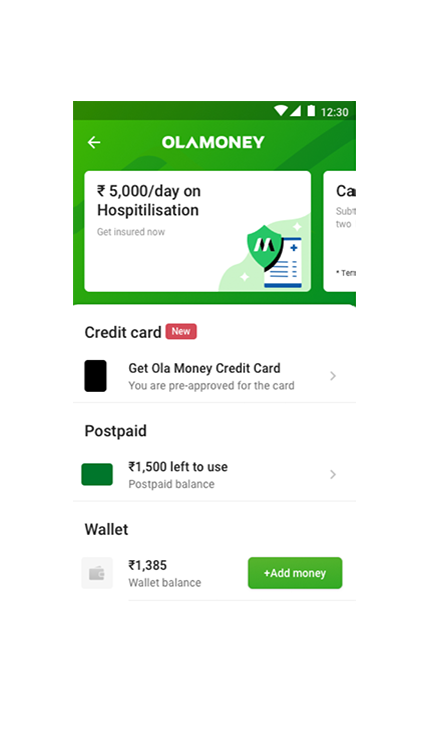

Why buy a Hospital Cash plan?

- Use as a blanket cover over your medical expenses

- Cover your travel and post discharge costs

- Protect your savings from loss of income

Benefits

Coverage upto 100 days in a year

All hospitals covered

No bills required for claims

Accident coverage from Day 1

Use independent of your mediclaim policy

Important things to know

- 30 days wait period on non-accidental hospitalizations

- 12 month wait period for named ailments and pre-existing diseases

- Maternity related hospitalizations are not covered

- Medically unnecessary treatments

Frequently Asked Questions

Have a question? Here you will find answers to the questions we get asked the most regarding OlaMoney Hospicash.

Minimum age is 91 days and maximum age is 65 years 364 days.

Overnight hospitalisation due to accident, communicable diseases like dengue, malaria, etc or hospitalisation due to any other ailments are covered under the policy with the exception of certain ‘permanent exclusions’ as described in T&C document.

Maternity, OPD, day-care or consultation, non-essential procedures such as cosmetic surgery, hospitalization specifically done for any preventive care for example vaccination. For detailed list of exclusions please refer to T&C document.

No you don’t require to take any medical tests. You just fill the form on the App, complete the payment and your coverage starts from the next day.

Definitely. We don’t ask for your medical bills at the time of the claim. You can claim full amount irrespective of your actual expenses. If your policy coverage is ₹5,000/day then in this case you get Flat ₹10,000.

Your daily sum insured depends on the coverage you select. For now it is available in 2 options- 3,000/day and 5,000/day. You can file a claim for up to 100 days in a year. This means that with a cover of ₹5,000/day you can claim up to ₹5,00,000 in a year.